This summer a fully AI-generated drug entered phase II clinical trials for the first time, as Hong Kong-based biotech Insilico Medicine broke new barriers with its potential treatment for idiopathic pulmonary fibrosis (IPF).

The milestone is emblematic of the AI focus in life sciences, which to-date has heavily skewed towards applying the technology across its research and development operations.

Making the drug discovery process quicker, and more effective in terms of patient outcomes, is a logical target, given the huge investments pharma and biotech companies make there. For companies like Insilico and some of their peers the focus is also one that’s paying off, with years shaved off traditional research timelines.

But, while it looks like there will be no shortage of AI progress for pharma and biotech R&D, the sector has had less experience with applying the technology within its commercial organisations. Now, with the rapid ascent of generative AI tools, this year is poised to be the turning point for commercial pharma organisations and artificial intelligence.

Generative AI has entered the chat

The spark behind today’s white heat of interest in, and often breathless commentary on, AI is ChatGPT. Launched at the end of November last year it took the conversational generative AI tool less than two months to become the fastest growing consumer app in the history of the internet. In doing so it has ignited interest, and spurred rapid progress, in text-generating competitors from Microsoft, Google, Amazon, Facebook-owner Meta, not to mention image-creating apps from firms such as ChatGPT’s developer OpenAI and Adobe.

The availability of these types of tools has not gone unnoticed by sales and marketing professionals working for some of the world’s biggest brands. One of those is Coca-Cola, which debuted an AI-generated advertising campaign in May. At Nestlé AI is used to track, correct and enhance the relevance of its social media assets, while Samsung is harnessing it to automate the creation and publication of banner ads.

The technology is also being specifically applied to improving customer experience (CX). Amazon recently expanded its efforts in this area to encompass the colossal amount of product comments its customers create. The online retail behemoth is using, for now on a US-only basis, generative AI to uncover meaning from that dataset, by highlighting the product features and customer sentiment most frequently mentioned in written reviews.

But, while AI may have entered the wider commercial mainstream, its potential and possibilities are generally still being explored by commercial pharma organisations. Beyond a few outliers that have systems up and running, many firms are either discussing or experimenting with the technology and formulating some ambitious plans.

From optimising to all-in with AI

One of the companies that’s clear about pharma’s AI opportunity is Sanofi, which said over the summer that it was “all in” when it came to artificial intelligence and data science. Naturally, its first example was in research, where the company has built multiple AI programs to improve predictive modelling and automate ‘time-sink’ activities, aiming to “slash research times” in the process, but its ambition is company-wide and includes business analysis. The centrepiece of Sanofi’s dive into AI is ‘plai’, an app that provides insights and personalised ‘what if’ scenarios from its real-time view of internal company data.

Around the same time Takeda discussed its approach to AI, with CEO and president Christophe Weber telling a July analyst call: “We think that all our employees eventually will have some application of AI for their jobs, so this is really a very high priority for us.”

Weber also shed some light on the ways Takeda’s sales and marketing operations are incorporating the tech, explaining that the company is “looking at optimising our interactions with doctors in a digital way and we are [already] using an AI algorithm”.

But he was clear that AI cannot exist in isolation. “We see a very high potential for the utilisation of AI in our business, but I would emphasise that it is data, technology, and AI,” he said.

Clearly those companies are far from the only ones making moves in AI. During the pandemic Pfizer accelerated the launch of its Digital Rep Advisor, an AI and machine learning tool that provides its field force with decision support to make their interactions with physicians more impactful by recommending the next best action to take. In another move that pre-dated the ChatGPT revolution, AstraZeneca began using AI coaching models improve the skills of its US field managers so that they are better equipped to help improve the performance of its salesforce.

More recently, Janssen saw streamlining opportunities for its content review process with the AI-powered Smart Reviewer system, which picks up language or factual errors, and flags information that needs to be validated. One of the standout elements of this approach is that it appears to be ‘invisible’ to users, but frees them up to focus on more complicated tasks.

It’s that approach that we will hear more and more about as AI develops and becomes fully embedded in our everyday workflows. It’s also one that Roche has taken with its in-house developed conversational AI chatbot. Work began four years ago and it now deals with those customer service calls judged to be more straightforward so that the company’s live agents can help customers with more complex needs. Not yet available in all countries, the chatbot has been used in areas like Asia Pacific, the Middle East and Europe.

Speaking about the firm’s approach at March’s European Chatbot & Conversational AI Summit in Edinburgh was Santosh Kumar, commercial service lead at Roche Diagnostics Asia Pacific, whose role covers both diagnostics and pharmaceuticals. He noted: “We are playing in the same level field, in our healthcare domain, so the only differentiator that we have now is the CX, customer experience, that is the only thing, and how we can bring the CX to gain the competitive advantage.”

As companies work to understand the potential competitive advantages of generative AI, some are carefully conducting in-house trials of the tech. At Bristol Myers Squibb, for example, an internal version of ChatGPT is available for employees from R&D to commercial and beyond to experiment with. This way of doing things, and it’s backed up with strict legal protection, ensure the data resides within its own ‘walled garden’ and avoids one of the challenges with using public large language models – after it’s input, where does the data go and who has access?

Data control

Data is, as Takeda’s Weber noted, fundamental to AI, whether generative or otherwise. Systems like ChatGPT aren’t named large language models for nothing, and the huge amounts of data they require have already seen tensions rising. Publications like The New York Times are starting to block OpenAI’s web crawler, preventing the company from using their content to train its AI models, and legal threats are flying around from media organisations and creative industries alike.

Meanwhile for users there’s a pressing need to understand the limitations and biases of the technology. Already one US lawyer who used ChatGPT for research, and subsequently cited cases that didn’t exist, is facing an embarrassing hearing of his own in a story that highlights some of the tech’s issues with accuracy, both in terms of AI having incomplete datasets and its propensity to invent facts, but also with bias.

That’s one of the concerns at a regulatory level, as the major bodies this year consider the technology and publish early guidance on it. Europe’s EMA published its draft reflection paper on the use of AI in the product lifecycle in July. One of points it made was that “All [AI/machine learning] efforts should be made to acquire a balanced training dataset, considering the potential need to over-sample rare populations, and taking all relevant bases of discrimination as specified in the EU principle of non-discrimination and the EU fundamental rights into account”.

The industry’s self-regulatory codes also need to be carefully applied to the technology, with a highly critical approach taken to suggested approaches about AI and from ChatGPT itself (see box). There are important differences between what the systems are able to do, such as collect and analyse patient data from social media, and what pharma should decide to do to ensure companies and individuals behave in an ethical and compliant manner.

A guest that’s here to stay

There are plenty of challenges for commercial pharma organisations as they set off, or continue, down the path towards fully adopting AI, but the rewards are clear too. Many of them will come from productivity benefits, whether in administrative tasks or content production, but greater value will accrue from the insights it could provide or the personalisation it could offer.

The dilemma for pharma will be how companies can best balance two competing needs – that of speed, so that they do not fall behind in such a fast-moving area, and that of caution, given that compliance and ethical considerations must be given due weight. Key to the latter with be building trust in the AI and the data, and how it is applied, for example by not leading the AI in certain ways with certain prompts.

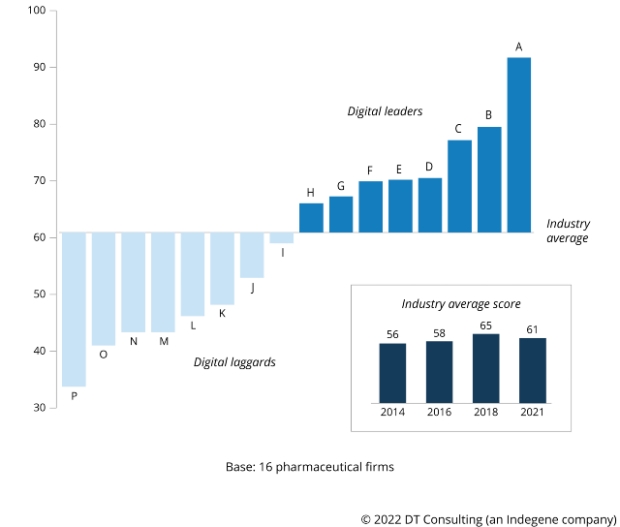

AI is an uninvited guest in the pharma world, but one that has taken up residence without asking for permission. Commercial organisations can ignore this or work out how best to employ the technology. For the latter firms, considerations of people and processes, as well as the technology, will be key. AI presents pharma with a digital transformation challenge, and it’s one on steroids.

• This article first appeared in the November 2023 issue of PME (Pharmaceutical Market Europe)