How pharma interacts with its key stakeholders matters – the customer experience (CX) that companies provide patients and healthcare professionals (HCPs) – can improve patient outcomes and increase business value. It’s a win-win for companies that are willing to prioritise this area.

As the sum of all perceptions about a firm’s services, products and people, CX has moved centre stage for pharma’s commercial organisations in recent years. The huge increase in digital interactions caused by COVID-19 has further challenged pharma to better understand and meet their customers’ changing needs. To successfully achieve this requires rethinking the overall ‘customer engagement model’.

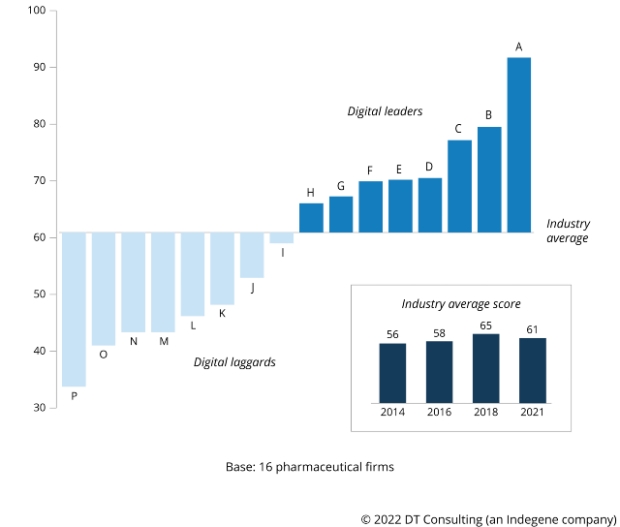

To find out how well global pharma organisations were approaching this shift during the acute phase of the pandemic, and what they will need to do in the future, we surveyed over 600 patients and 2,000 HCPs. Respondents came from Germany, France, the UK, Spain, Italy, and the US, with some of the HCPs also drawn from Canada. Their answers were put into our Customer Experience Quotient® (CXQ®) framework so that we could benchmark the companies involved.

The findings shine a light on how customers currently engage with pharma, how well they think firms are doing, and – critically for the current transitional stage of the pandemic – how they would like to engage with the industry in the future.

Improving the patient experience

The ubiquitous phrase ‘patient-centricity’ is generally underpinned by virtuous intentions, but it can be a little vague to say the least. Understanding and meeting patient expectations by providing an excellent CX is a practical way to demonstrate companies have made progress in their laudable aims. Sadly, pharma’s not there yet.

Our 2022 CXQ® study of pharma’s patient interactions found the pharma industry has yet to provide patients with a good CX and consequently companies are not maximising their opportunities to improve health outcomes.

The online survey of 628 patients was fielded in collaboration with the Paris-based patient community Carenity and found pharma channels perform poorly for patients. Looked at in more detail, from all of the possible perceived engagement channels between pharma and patients, it was the humble telephone they were most satisfied with, though even that experience could only manage a fair score (the ranking moves through poor, fair, and good, to excellent).

But if they were most happy with the telephone services they think pharma provides, the patients in our study were most likely to engage with a company via email, suggesting a reticence to use a new app, navigate a new website, or try new online chat technology.

Email will continue to be the communications channel of choice for the patients in our study, but the work found a major disconnect between patients’ future channel preferences and the channel mix pharma companies currently use. In fact, the data suggests that when it comes to trying to reach patients too much emphasis is placed on social media and traditional print media. Is pharma stuck in thinking the old mix of engagement channels is as effective as exploring a fresh, future-proof set of customer engagement principles?

Benchmarking the 21 pharma companies in our CXQ® study saw patients judge Biogen and Merck & Co the closest to provide a good experience – scoring that leaves the industry with plenty of work to do if it is to start providing experiences that patients consider excellent.

Disconnected experiences hamper trials

Within our CXQ® survey of patients, 85 were either currently taking part in a clinical trial or had participated in one within the last 12 months and we asked them about their trial expectations and then their actual experiences. Despite most clinical trials still either failing to recruit the number of participants they need on time, or seeing them leave the study before it ends, R&D organisations within pharma don’t yet apply the principles behind CX consistently.

So, here too, we found a sector disconnected from the needs of its ‘customers’, relying heavily on face-to-face interactions – even in the current climate – and making only limited use of digital tools, the use of which is welcomed by many trial participants. However, this does mean that pharma’s clinical trial interactions have a significant margin of improvement in quantity and quality, and this could contribute to increased participation and completion rates – a business benefit that would save millions of dollars.

Clear communication was found to be a fundamental expectation from trial participants: 31% of respondents said that the effectiveness of communication with researchers was one of the three most important factors for whether or not to complete the study. A similar proportion of respondents said the effectiveness of communication with medical staff made it on to their top-three list.

Once again, email was the most preferred channel for activities such as completing participation surveys, filling in informed consent forms and asking general questions about the trial and their participation. In fact, it was only when it came to having a consultation with researchers or clinicians that our respondents preferred to have face-to-face contact at the trial site, rather than using email. Connections with participants in trials are key to providing them with better clinical trial experiences, and therefore increasing the effectiveness of the industry’s research.

HCPs judge pharma experiences to be average

Turning to our separate study of HCPs, pharma companies are providing them with better experiences than they currently provide patients, but CX is still average – with no firm judged poor or excellent – and no company really differentiating itself. Leading the pack were Novo Nordisk, Lilly and Roche – Novo benefited from its performance in digital channels, while Roche took a slim lead in terms of its use of non-digital channels.

The study was very much taken in the shadow of COVID, being conducted from December 2020 to February 2021, during the pandemic’s second wave of infections. Given the variety of COVID-19 measures taken by different governments, these experiences might have occurred before, during, or after local lockdowns. It encompassed 4,000 interactions among some 2,000 HCPs across seven countries and seven specialty areas.

Looking at those specialty areas, HCPs working primarily in diabetes reported better experiences than those in other therapy areas. They were more impressed with the relevance, simplicity and trustworthiness of pharma information and services than their peers in other therapy areas. Meanwhile, the experiences provided by pharma firms focused on respiratory and cardiology treatments were less likely to satisfy HCPs.

HCP channel preferences will provide another challenge for pharma, going back to the need to critically look at firms’ customer engagement models, with our survey charting the way these are set to change. There was, of course, a huge shift in the way HCP engaged with pharma companies for disease and product information and services during the pandemic. The much-discussed pivot to digital saw a switch from face-to-face to virtual contact that favoured live videoconferencing, emails from representatives and recorded online events.

Post-COVID, things will swing back to some extent and HCPs want a hybrid approach. In fact, there was a clear desire for more face-to-face contact with the industry once the pandemic wanes, with more than half of our respondents saying they were looking forward to more in-person events and in-office meetings with sales reps. However, HCPs also want pharma to either continue or further increase its use of virtual channels.

Pharma’s not meeting expectations

The three CXQ® studies discussed in this article illuminate a world in flux. Adjustments are inevitable as, and when, we exit the pandemic, so the key questions for many in pharma will be, ‘How far will preferences revert to pre-COVID levels? and ‘Have customer expectations fundamentally changed post-COVID?’

As companies mull over that question and track the emerging trends in how patients and HCPs would like to engage with the industry in the future, the disconnect between what its customers expect and what the industry is giving them should provide companies with serious pause for thought.

It’s clear that pharma does not yet meet patient and HCP expectations, with ramifications for health decision-making, clinical trial success and future engagement. Excellent customer experiences could be a key driver of business value, but pharma companies have yet to take advantage of this.

• This article first appeared in the March 2022 issue of PME